For anyone who’s ever wondered why the federal government gets a taste of your annual earnings like some kind of mafia godfather, the answer goes all the way back to the Civil War. And the saga doesn’t end until the turn of the 20th century. It’s safe to say that no one who saw income taxes as a temporary, extraordinary measure ever thought we would still have one more than 160 years later.

The Road to Secession and Civil War

When Abraham Lincoln was elected as President of the United States in the election of 1860, the fledgling Republican Party’s platform promised only to stop the expansion of slavery into new territories, not to end the practice where it already existed. Before being elevated to the nation’s highest office, Lincoln had been a self-taught lawyer, a one-term Whig congressman, and a public speaker. It was because of his public speeches and debates that his anti-slavery views were well-known.

Despite his promise not to interfere with southern slavery, his reputation was too much for slaveowners. Lincoln’s election outraged the South and immediately triggered the secession of seven states from the Union. By the time he actually took office in March 1861, 11 states had left the Union and formed the Confederate States of America. No matter his views on slavery, Lincoln believed the Union could not be dissolved at will; that the Constitution bound the states together forever. Therefore, he was duty-bound to fight to preserve it by fighting the states in open rebellion.

The only question was: how to pay for it?

The Birth of Income Tax During the Civil War

Before states started trying to leave the Union, the federal government generated most of its revenues from tariffs, taxes levied on goods arriving in American ports. For the North, this was great. The tariffs protected domestic manufacturing from cheap imports. In the South, the import duties just made everything more expensive and hurt southern exports (cotton) in foreign ports. The federal budget was all well and good until the Civil War began, when spending on troops, supplies, and weapons increased. Overall spending skyrocketed 2,000%. The China of 1860 wasn’t about to buy a bunch of American debt; it was fighting its own rebellion.

To help pay for the war, Congress passed the Revenue Act of 1861, which increased tariffs on certain imports, levied a federal property tax, and – for the first time ever – imposed an income tax. The tax was a flat 3% for anyone making more than $800, which was almost $30,000 in today’s dollars – but relative to GDP, the corresponding income today would be around $385,000.

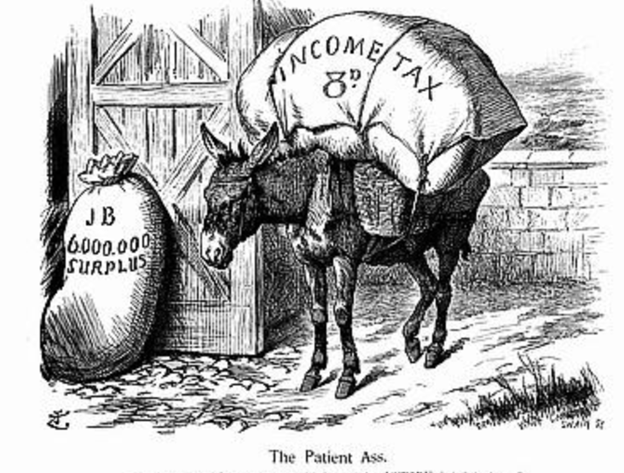

On July 1, 1862, Lincoln signed a follow-up bill into law, the Revenue Act of 1862. This law created tax brackets and a higher tax rate for Americans with higher incomes. Another Revenue Act was passed in 1864, increasing these taxes and introducing a new bracket. The income tax was repealed in 1872, as the government no longer needed the extraordinary measure.

Legal Challenges and the Path to Permanent Income Tax

So, how did we end up with a permanent income tax?

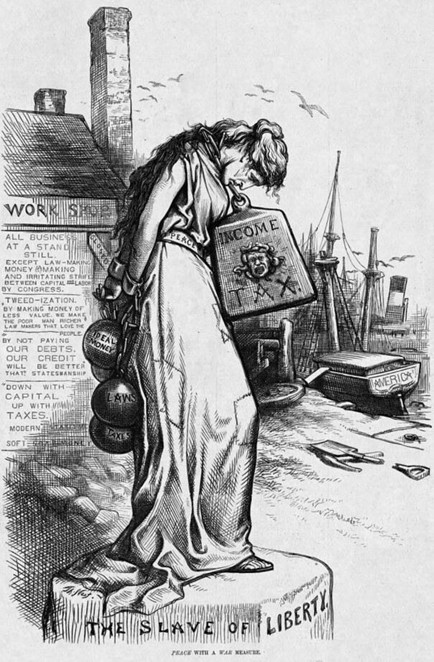

Just because the tax revenues were used to preserve the Union and end slavery doesn’t mean everyone was on board with it. There were several challenges to the constitutionality of income taxes, specifically regarding the authority of Congress to levy taxes.

Article I, Section 8 of the Constitution says, “The Congress shall have power to lay and collect taxes, duties, imposts and excises, to pay the debts and provide for the common defense and general welfare of the United States; but all duties, imposts and excises shall be uniform throughout the United States.”

Illinois lawyer William Springer argued before the Supreme Court that the 1864 tax was a direct tax that wasn’t “apportioned” – or uniform – throughout the United States. The Court disagreed, saying the tax was more of an indirect excise tax (a tax on the profit you made from working) and wasn’t protected under that clause. In 1894, the federal government decided to lower tariffs and offset the resulting losses with a 2% income tax.

When Charles Pollock, a minor shareholder of a New York-based loan and trust company, discovered that the bank was going to pay the tax, he sued the bank, and the case eventually made its way to the Supreme Court. This time, the tax was based on rents, dividends, and interest, which triggered the Court to view it as a direct tax, one that was required to be imposed in proportion to the states’ populations. But that’s obviously not the end.

In 1909, Congress passed the 16th Amendment to the Constitution, which simply overruled the Supreme Court’s ruling in the Pollock case, saying:

“The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.”

Read More on the Together We Served Blog

If you enjoyed reading the article “The Civil War Resulted in America’s First-Ever Income Tax”, we invite you to read other military stories on our Blog. We share military book reviews, veterans’ service reflections, famous military units and more on the TogetherWeServed.com blog. If you are a veteran, find your military buddies, view historic boot camp photos, build a printable military service plaque, and more on TogetherWeServed.com today.

0 Comments