Many monetary benefits administered by the U.S. Department of Veterans Affairs (VA) depend on your life status. This is defined as the Veteran’s marital status and the number of dependents in the family. To ensure you receive the correct payment – no less or no more – it is essential to have this information accurately reported to the VA at all times. Failure to do so can have consequences that can cause financial hardship for the Veteran.

An example demonstrates this.

Marriage and Its Effect on VA Benefits

Let’s start with a male Veteran who is 50 percent service-connected. In this example, he is not married, or as the VA describes it, “alone.” Based on the payment schedule for 2024 (you can find this schedule), he will receive $1,075.16 each month.

The Veteran marries. Now, for VA purposes, he is considered a “Veteran with Spouse,” his monthly payment will increase to $1,179.16, provided this information has been reported to the VA.

The first key point to understand is the VA’s definition of marriage. The VA recognizes a Veteran’s marriage if it was recognized by law where at least one of the parties resides. The VA also recognizes same-sex marriages and common-law marriages.

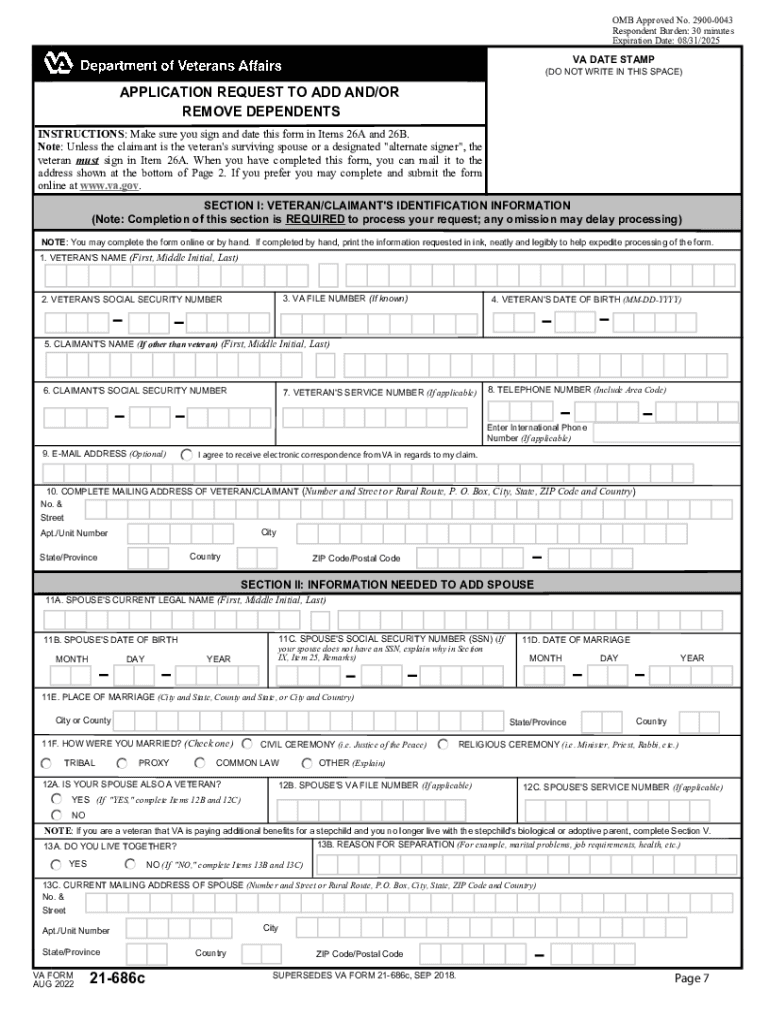

The second key point is the importance of notifying the VA of the marriage. This can be done online or by using VA Form 21-686c. The form explains the evidence needed based on the type of marriage (by a Ceremony, establishing Common Law Marriage, Tribal Marriage, or Proxy Marriage).

The Impact of Children on VA Benefits

Extending this example, the couple has a child. The VA now considers him a” Veteran with Spouse and 1 Child.” Assuming the Veteran informed the VA promptly, his monthly payment would increase to $1,262.15.

Reporting this information can be done online or using VA Form 21-686c. The instructions also explain the specific evidence to be supplied for the categories of children: Unmarried Child, School-Age Child, Stepchild, Adopted Child, and Child Permanently Incapable of Self-Support.

The Consequences of Delayed Reporting: Maintaining Your Life Status Current

In both variations of an addition to the family in these examples, the timeliness of reporting the information to the VA matters. Generally, if it has been longer than a year since marriage or the addition of a child, the VA may only pay back to the date you submitted your dependency claim.

As you can imagine, reporting events similar to these, which lead to an increased family size and VA benefits, are usually done on time. When the opposite happens, there are often delays, which can have significant consequences.

Let’s continue with the example to detail this.

The same couple divorces. Now, the VA describes the Veteran as a “Veteran with one child only.” (This would have been the same had the spouse died.) In this new status, the Veteran’s monthly payment would be $1,144.16 – a decrease of $117.99 from his payment during his married status.

If the Veteran reports this information to the VA in a timely manner, the decreased payment will take effect quickly. Issues arise, however, when there is a delay in reporting this information.

For example, for whatever reason, the Veteran doesn’t report his divorce to the VA until two years after it became official. This means that during those 24 months, he was overpaid $2,831.76. That is 24 months multiplied by $117.99 per month.

Once the VA is notified, it will compute this math and begin to recover the overpayment. Without the Veteran’s intervention, it will collect this money by withholding monthly payments until the total overpayment has been repaid.

In this example, the VA will not pay his regular benefit of $1,144.16 for two months, and his third monthly payment will only be $600.72. A Veteran, depending on this payment each month for living expenses, will find that withheld payments in this way create financial problems. These problems can cause stress, increases in anxiety, and frustration. To set up a more acceptable repayment schedule, the Veteran must contact VA’s Debt Management Center (800.827.0648).

Ensuring Financial Stability: Timely Reporting Is Key

A similar event occurs in this example when the child turns 18 and gets a job. He is no longer considered a dependent; the Veteran is now considered “alone,” and his monthly payment decreases to $1,075.16. Unless this is reported to the VA in a timely manner, the risk of overpayment and the consequences of a harsh repayment schedule exist.

This extended example clarifies the importance of having your life status accurately understood by the VA. It ensures you receive increased payments based on certain circumstances and prevents overpayments from occurring. This last point is critical, as overpayments eventually result in the VA collecting that money back from the Veteran, potentially on a schedule that may cause financial hardship. If in doubt, call the VA to confirm your status at 800.827.1000.

About the Author Paul R. Lawrence

Paul R. Lawrence, Ph.D., served as Under Secretary of Benefits at the U.S. Department of Veterans Affairs from May 2018 to January 2021. He is the author of “Veterans Benefits for You: Get what You Deserve,” available from Amazon.

Read About Other VA Updates

If you enjoyed reading the article “Keep Your Life Status Current With the VA”, we invite you to read the stories of VA Updates on our blog. In addition to our profiles of celebrities who served, we share military book reviews, veterans’ service reflections, famous military units and more on the TogetherWeServed.com blog. If you are a veteran, find your military buddies, view historic boot camp photos, build a printable military service plaque, and more on TogetherWeServed.com today.

.

0 Comments