Homeownership has many positive features for Veterans and their families. A home provides shelter and safety. With planning, a home is an anchor to a strong community with solid schools for children. Connecting to the community can bring purpose and a sense of belonging to replace those experienced in the military.

Empowering Veterans Through Homeownership

Another positive feature of homeownership is the increase in net wealth, which can happen when the home appreciates in value over time. For example, if you purchase a $500,000 home and sell it later for $600,000, you keep the $100,000 extra that remains once you pay off the old mortgage. This money can be used for many reasons, including children’s college education, starting a business, or retirement. For many, including Veterans, your home may be the largest asset in your portfolio.

Most people purchase a home with the assistance of a financial institution and a mortgage – an agreement to pay for the purchase monthly over a period of years – traditionally 30 years. Non-veterans who purchase a home normally have to come up with a downpayment as a requirement to get a mortgage. This is often expressed as a percentage – i.e., 10 or 20 percent – of the home’s value. In the example of purchasing a $500,000 home, this would be $100,000 if 20 percent was required.

Saving $100,000 for this purchase often delays homeownership for years, as the potential owner defers purchases to accumulate this money. Many will fail to save and, as a result, never own a home. A successful civilian home purchaser will also find he has to pay Private Mortgage Insurance (PMI) each month to protect the financial institution if they can’t make their mortgage payments.

Veterans, due to their military service, face a very different situation because of the Veteran benefit known as the Home Loan Guaranty. This is the formal name for the ability to purchase a home with no money down. In short, unlike a civilian counterpart, a Veteran doesn’t have to save for years and can achieve home ownership earlier. Further, a Veteran using this benefit won’t pay PMI and often receives a lower interest rate on their mortgage.

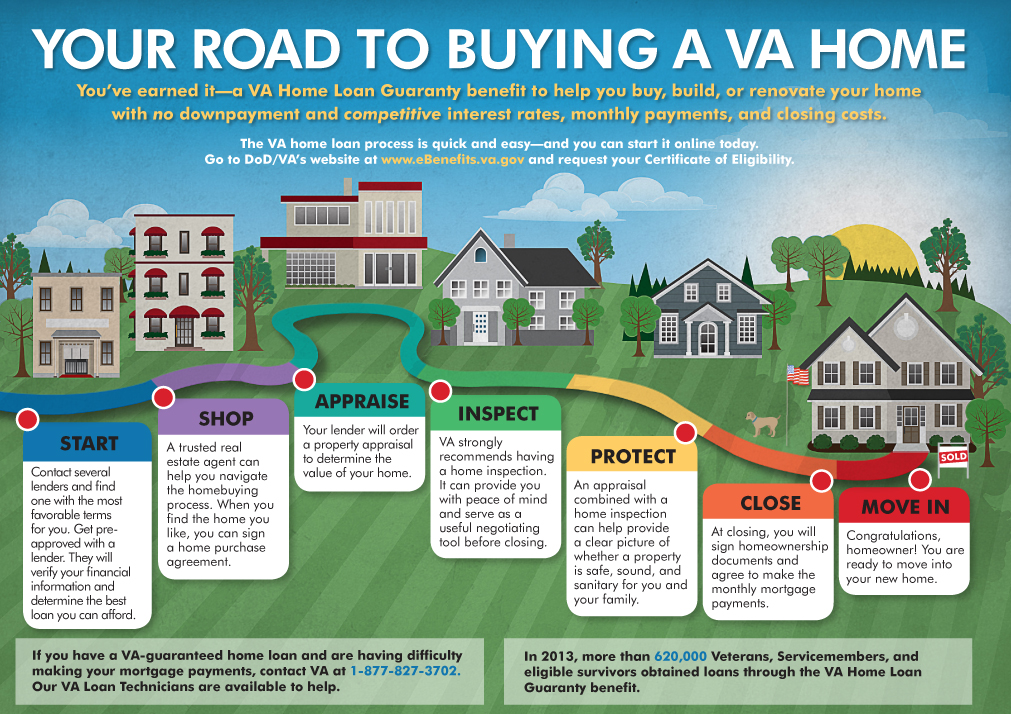

Navigating Veterans Affairs Home Loans: A Step-by-Step Guide

Eligibility for this benefit depends upon your length of service and discharge status. Learn more at VA. Being eligible doesn’t necessarily mean you will qualify for a mortgage from a financial intuition. This is key because the VA only guarantees the downpayment; the Veteran has to obtain a mortgage. That often depends on passing a credit check and demonstrating you have sufficient income.

• Credit—Yours will be checked using the standard 300 to 850 score. There is no minimum score, but generally, the higher the score, the better. Additional reviews of payment history will be made to determine how likely mortgage repayment will be.

• Sufficient income – there is no minimum income, but your Debt-To-Income (DTI) ratio will be reviewed to ensure you can repay the mortgage. VA uses 41% as the guideline, but financial institutions may use a different number.

The process to use this benefit is as follows:

- Obtain a COE from VA (explained below)

- Select a lender

- Find a suitable home

- Get the home appraised by a VA-approved appraiser (explained below)

- Confirm your loan is approved

- Close on your home and move in

Your Certificate of Eligibility (COE) is the official document that demonstrates your eligibility to participate in the VA home loan program. Your lender may be able to obtain it for you, but you can also get it online at VA.gov or complete VA Form 26-1880, “Request for Certificate of Eligibility,” and return it via mail.

VA will have the home appraised by an approved appraiser. They do this to get an informed opinion on the house’s value. When the appraisal is complete, a report is provided. Issues may arise if the property doesn’t appraise at or above the sale price. These will be discussed with the buyer.

What Does This Cost?

You will be asked to pay the Funding Fee. This is a percentage of the mortgage that enables the VA to recoup the costs of administering this program. It is based on the number of times you have used the program and the size of your downpayment. A detailed explanation can be found here.

You can pay the Funding Fee by writing a check at closing. Most, however, add the Funding Fee to their mortgage, increasing the size of the mortgage but enabling them to pay it over the life of the mortgage. The Funding Fee may be waived for certain reasons, the most common of which is the Veteran being service-connected.

If you have questions about the program, call VA’s Home Loan Guaranty experts at 877-827-3702.

About the Author Paul R. Lawrence

Paul R. Lawrence, Ph.D., served as Under Secretary of Benefits at the U.S. Department of Veterans Affairs from May 2018 to January 2021. He is the author of “Veterans Benefits for You: Get what You Deserve,” available from Amazon.

Read About Other VA Updates

If you enjoyed reading the article “What If My Veteran Dies?”, we invite you to read the stories of VA Updates on our blog. In addition to our profiles of celebrities who served, we share military book reviews, veterans’ service reflections, famous military units and more on the TogetherWeServed.com blog. If you are a veteran, find your military buddies, view historic boot camp photos, build a printable military service plaque, and more on TogetherWeServed.com today.

.

0 Comments